Orb Envisions a New WorldCoin Asset

WorldCoin's Orb – a beacon of identity verification, heralding a new age of accessible cryptocurrency by Melvin Hoyk.

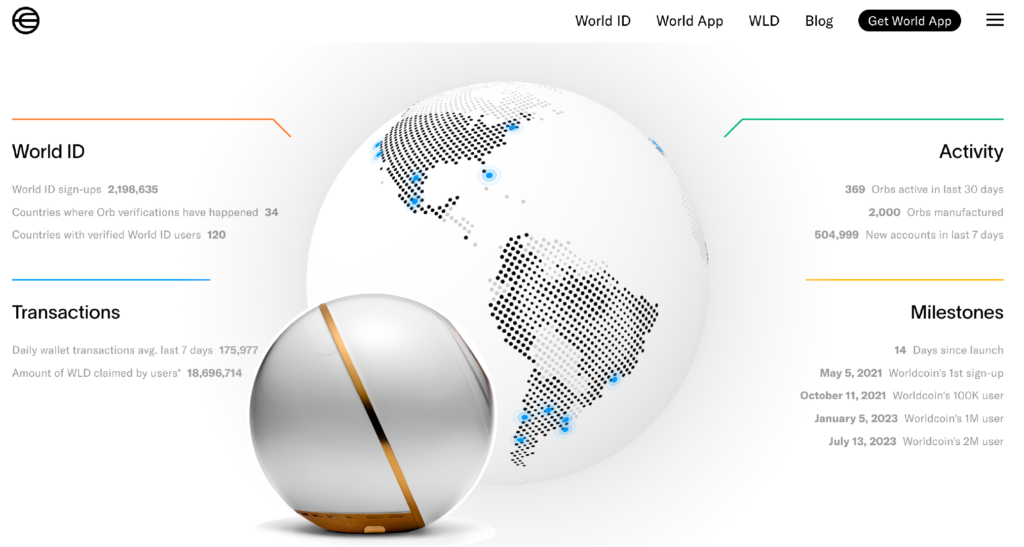

WorldCoin is a project that aims to create a global identity and financial network that is owned by everyone. It consists of a digital currency called WLD and a digital identity called World ID. To get a World ID, users need to visit an Orb, which is a biometric verification device that scans their iris and verifies their humanness and uniqueness. The Orb then deletes the image and generates a zero-knowledge proof that the user is a real person. The user can then claim a share of WLD tokens for free, as well as use their World ID to prove their identity online without revealing any personal information. WorldCoin claims that this system can increase economic opportunity, enable global democratic processes, and potentially pave the way for AI-funded universal basic income (UBI). In this article, we will explore the benefits and challenges of using iris scanning and zero-knowledge proofs for identity verification and financial inclusion, as well as the potential risks and limitations of WorldCoin.

The Benefits of Iris Scanning and Zero-Knowledge Proofs

One of the main advantages of using iris scanning for identity verification is that it is highly accurate and secure. The iris is a unique feature of the human eye that does not change over time, unlike fingerprints or facial features. It is also difficult to forge or spoof, as it requires a high-resolution image and a live scan. Moreover, iris scanning does not require physical contact with the device, which reduces the risk of contamination or damage.

Another benefit of using iris scanning is that it can be combined with zero-knowledge proofs (ZKPs), which are cryptographic techniques that allow one party to prove something to another party without revealing any information other than the fact that the statement is true. For example, Alice can prove to Bob that she knows a secret password without telling him what it is. ZKPs can be used to create digital identities that are anonymous, verifiable, and unlinkable. This means that users can prove their identity without disclosing any personal information, such as their name, address, or date of birth. They can also use different identities for different purposes, such as voting, banking, or social media, without linking them. This enhances the privacy and security of the users, as well as their control over their own data.

How WorldCoin Works in Practice

WorldCoin works by distributing WLD tokens to anyone who creates a World ID using an Orb device. The Orb device is a spherical metal object that contains a camera and a screen. It scans the user’s iris and generates a ZKP that proves that the user is a unique and real person. The ZKP is then sent to the WorldCoin network, which verifies it and allocates a share of WLD tokens to the user’s wallet. The user can then use their WLD tokens to access various services and platforms that accept them as a form of payment or reward. The user can also use their World ID to prove their identity online without revealing any personal information.

WorldCoin launched its beta program in July 2023, after raising $25 million from investors such as Andreessen Horowitz, Coinbase Ventures, Reid Hoffman, Naval Ravikant, and Sam Altman (OpenAI). The beta program involved more than 2 million users from 20 countries who each received 25 WLD tokens. WorldCoin plans to distribute 10 billion WLD tokens over the next 10 years, with 70% going to users, 20% going to developers and partners, and 10% going to the team and investors. WorldCoin also aims to deploy thousands of Orb devices worldwide, especially in developing regions where access to digital identity and financial services is limited or nonexistent.

The Potential Risks and Limitations of WorldCoin

While WorldCoin has an ambitious vision and an innovative technology, it also faces some challenges and criticisms. One of the main concerns is the privacy and security of the user’s biometric data. Although WorldCoin claims that the Orb device deletes the iris image after generating the ZKP, some experts doubt whether this process is truly secure and irreversible. Moreover, some users may be reluctant to share their iris scan with a third-party device that they do not fully trust or understand. There is also a risk of coercion or fraud, where someone may force or trick another person into scanning their iris for malicious purposes.Another challenge for WorldCoin is scalability and adoption. While WorldCoin has distributed millions of WLD tokens to its beta users, it still needs to convince more people and platforms to use them as valuable currency or utility tokens. WorldCoin also needs to ensure that its network can handle increasing transactions and users without compromising its speed, security, or decentralization. Furthermore, WorldCoin needs to comply with the legal and regulatory frameworks of different jurisdictions, which may vary in their recognition and treatment of digital identities and cryptocurrencies.

One of the recent issues that WorldCoin faced was an alleged Sybil attack, which is a type of attack on a computer network service in which an attacker subverts the service’s reputation system by creating a large number of pseudonymous identities and using them to gain a disproportionately large influence. According to Trusta, a platform that analyzes on-chain data, 130 clusters of fake identities manipulated 20 or more WLD tokens each, by using biometric verification to create multiple Gnosis Safe wallets and claim WLD tokens for free, then transferring them to other addresses for profit. This suggests that WorldCoin’s identity verification system may not be as secure or reliable as it claims to be and that its distribution of WLD tokens may not be fair or equitable.

Another tweet from Eric Wall questioned the economic control of the keys linked to the iris scans of the users, implying that the users do not have full ownership or access to their World IDs or WLD tokens and that they may be vulnerable to fraud or manipulation. This raises doubts about the decentralization and sovereignty of WorldCoin, and whether it truly empowers its users or exploits them.

Conclusion

WorldCoin is a project that aims to create a global identity and financial network that is owned by everyone. It uses iris scanning and zero-knowledge proofs to verify the humanness and uniqueness of its users and distributes free WLD tokens to them. WorldCoin claims that this system can increase economic opportunity, enable global democratic processes, and potentially pave the way for AI-funded universal basic income. However, WorldCoin also faces some challenges and criticisms, such as privacy, security, scalability, adoption, and regulation. WorldCoin is not the only project that uses biometrics and blockchain for identity verification and financial inclusion, as there are other similar projects or solutions that have different approaches and goals. WorldCoin is an interesting and innovative experiment that may have a significant impact on the future of digital identity and finance.

Will I give WLD a try? I’m in Malaysia now, and the nearest countries that provide Orb are Singapore and Hong Kong. With the sign-up using Orb, you will get 25 WLD tokens for free, which are worth $2.45 USD each, or around $61.25 USD in total. With that amount, I will just be a spectator for now. I wouldn’t spend money on flight and accommodation expenses just to get that $61.

You can find more information about WorldCoin and its Orb here:

https://worldcoin.org/Understanding the Orb and why WorldCoin uses biometrics

Opening the Orb: A look inside WorldCoin’s biometric imaging device