The Inner Workings of Blockchain

Embracing Decentralization for Power Distribution Across Nodes by Melvin Hoyk.

Blockchain technology, with its promise of decentralisation, transparency, and security, has revolutionised numerous sectors, from finance and healthcare to the supply chain and education. But how does blockchain work, and what makes it so different from the traditional internet infrastructure? Let’s explore these questions and more.

Centralised Vs. Decentralised Networks

The traditional internet infrastructure operates on a centralised model. Information flows through servers owned by Internet Service Providers (ISPs), tech giants like Google or Amazon, or other third parties. While effective, this system presents potential vulnerabilities, such as single points of failure or misuse of data.

Unlike traditional systems, blockchain operates on a decentralised model where control isn’t held by a single entity. Instead, the network is maintained by numerous nodes, or computers, participating globally. This means anyone, anywhere with an internet connection can join the network. Consequently, blockchain and its associated cryptocurrencies are not restricted to the rules or economy of any one country. Even if one nation imposes limitations, the activities can continue in other parts of the world. In essence, blockchain is a global, democratised system of digital trust.

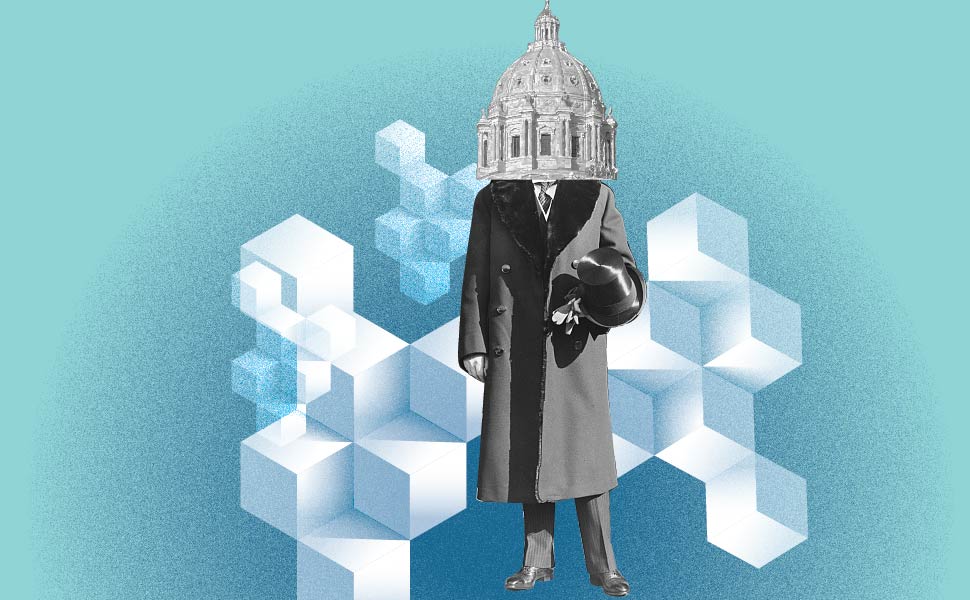

The Role of Nodes in a Blockchain Network

Nodes are the lifeline of a blockchain network. Each one holds a copy of the entire blockchain, including all transactions ever made. They follow a consensus protocol to agree on the contents of the blockchain, ensuring no single party can manipulate the data.

Nodes have a crucial role in the functioning of the blockchain network. They validate transactions and record them onto the blockchain. When a new block is added, all nodes must agree on the validity of the transactions it contains.

Importantly, a node must be online to perform its functions. If a node goes offline, it will not be able to validate and propagate transactions. However because there are numerous nodes in a network, the system can withstand several nodes going offline without compromising the operation or security of the blockchain.

Who Runs the Nodes?

An assortment of participants run nodes:

- 1. Individual enthusiasts who support the technology or philosophy of decentralisation.

2. Miners and stakers who validate transactions and create new blocks in return for rewards.

3. Businesses and service providers offering blockchain-related services need up-to-date blockchain data.

4. Developers and researchers who conduct tests, develop blockchain software, or perform data analysis.

5. Non-profit foundations and consortiums run nodes to support the network.

In this decentralised network, each participant has their reasons and benefits for running nodes, reinforcing the network’s resilience and security.

Blockchain and Node.js: A Clarification

One common point of confusion is the difference between blockchain nodes and Node.js. Blockchain nodes are computers maintaining the network, while Node.js is a JavaScript runtime environment used for developing server-side applications. The term “node” in both instances refers to their function as a network node, albeit in entirely different contexts.

The Blockchain Public Library Metaphor

- 1. Blockchain as a Library: Imagine the blockchain as a public library that exists everywhere in the world, with many branches spread across a network of computers. 🏛️

2. Blocks as Books: Each book (block) contains a list of transactions, like a historical record. These books are written in ink – entries are permanent and unalterable. 📚

3. Nodes as Librarians: Our library wouldn’t function without librarians. Similarly, nodes in the blockchain maintain the system. They have a copy of the entire library (blockchain) and follow the network’s rules. Librarians (nodes) validate new entries (transactions) and add them to new books (blocks). 📖

4. Chain of Books: The books are arranged chronologically, forming a chain, and each new book added makes the previous ones more secure. 🔗

5. Immutable Rules: The library has strict rules for borrowing and returning books – these reflect the unchangeable nature of blockchain transactions. 📖

Our public library metaphor simplifies the core features of blockchain technology: decentralisation, immutability, security, and transparency. Think of the blockchain library as always open 24/7, ensuring efficient transactions, with librarians (miners) maintaining order.

Conclusion

Blockchain technology has significantly transformed our perception of secure, transparent, and decentralised transactions. By understanding its inner workings, we can better appreciate its potential and applications. Whether it’s individuals with an interest in decentralisation, businesses leveraging the technology, or developers exploring new possibilities, everyone contributes to maintaining the robust and secure functioning of the blockchain network.

Blockchain technology, while complex, operates on the principles of transparency, security, and decentralisation, making it a revolutionary force in today’s digital world.